Enhanced Regulatory Compliance in Financial Markets with Proof Systems

All blockchain-based chain of custody solutions on Dragonchain can be seen as proof systems. Most traditional systems document chain of custody with the required documentation, however, there is no way to prove the data or evidence was handled and archived without tampering. A significant amount of trust is involved with the traditional chain of custody processes.

When people discuss chain of custody it's often framed from a criminal justice perspective. A simple Google search for chain of custody results in ample articles about how to handle evidence. When Dragonchain talks about chain of custody, it’s much more than cataloging evidence. For us, chain of custody solutions includes all types of data documentation across all industries and situations. By replacing the “paper” copy documentation with a digital copy of documentation secured by blockchain and accompanied by measurable proof, Dragonchain can offer full integrity throughout the entire chain of custody.

Blockchain has already made its mark in the global supply chain industry. Proof systems for supply chains provide more traceability to consumers by transparently showing the full origin of products throughout the entire supply chain. By documenting and securing every point in the process on blockchain, businesses can maintain their brand’s credibility and their product’s integrity.

Dragonchain’s chain of custody solution, Proof Systems, can be used in a vast majority of industries for a wide array of implications. According to the survey 'Proof Systems in Blockchain', general applications and use cases can be found in public and private records, identity, attestation, escrow contracts, physical and intangible assets, and in the Fintech and payments industry.

Powered by Dragonchain’s Interchain technology and protected by hash power, Proof Systems leverage multiple blockchain systems to prove that transactions occurred at some point in the past with hundreds of millions of dollars of measurable proof.

Transaction Security Value shows, in real time, how many dollars ($USD) of energy consumption has been used to secure a transaction. The security value of a transaction starts with millions of dollars of proof on the first day and increases to billions of dollars within a few months. Every subsequent block securing the transaction makes tampering with any transactions economically debilitating.

The Need for Proof Systems

Dragonchain’s Proof Systems are all about providing measurable proof of compliance to consumers, regulators, and partners of industry regulations and standards.

As technology continues to make its mark on the consumer/business relationship, so does a lack of confidence. Data breaches alone have proven problematic and costly with an economic impact of $600 Billion. Unfortunately, data breaches aren’t solely to blame for the lack of trust between consumers and businesses.

Inauthentic products, false claims, low-quality materials, or affiliation with child labor can all lead to credibility and integrity issues for brands. Forbes recently reported on a study by the Australian Strategic Policy Institute (ASPI) that found “strongly suggests forced labour” for well known and admired companies such as Nike, Adidas, Apple, Microsoft, and Samsung.

The integrity of a brand is more than highlighting the good. It includes the good and the bad. It's the truth. Businesses work hard to gain the trust of their customers. Simply making claims and commitments does not prove integrity.

A blockchain-based chain of custody solution provides new ways for businesses to restore trust between consumers and businesses. Proof systems offer assurance the outcome of an event occurred with certainty and confidence through automation and independent verification.

Proof reports, like the one pictured above, can be distributed to authorized parties or consumers to enhance accountability from source to consumption and every step in between. The report can selectively expose all or part of any transaction class to partners or customers from the supply chain process. Dragonchain’s Proof Systems provide measurable proof from source to customer the authenticity of your product, brand, or data.

Chain of custody solutions using blockchain have a long future ahead. And although implementation of blockchain systems into legacy systems is just getting started there is curiously one area that has not had the fortune to use this technology, until now.

How Proof Systems are Used Already

Dragonchain built and conducted an operational proof of concept (POC) to prove compliance within several areas of a cryptocurrency exchange. Dragonchain’s Proof System gave the exchange the ability to provide proof to their customers and regulators that they are compliant in a multitude of regulations and policies.

Never Ending Regulations

Last year the Securities and Exchange Commission warned firms to devote adequate resources to compliance. The warning led to a debate on if its the amount of money invested in compliance or the individual risk profile. Some say 5% of revenue should go into compliance, while others say it depends on the firm and individual risk profiles. Wherever opinions fall, there is no debate that government scrutiny is robust across the finance industry, including for exchanges. References tend to be made to the five major federal securities laws that were mostly created as a result of the New Deal in the 1930s:

- Securities Act of 1933

- Securities Exchange Act of 1934

- Trust Indenture Act of 1939

- Investment Company Act of 1940

- Investment Advisers Act of 1940

Those laws have further been amended or expanded over the years including the Investment Advisers Act of 1940, Securities Investor Protection Act of 1970, Securities Litigation Reform Act (1995), Insider Trading Sanctions Act of 1984, Insider Trading and Securities Fraud Enforcement Act of 1988, Sarbanes-Oxley Act of 2002, Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Jumpstart Our Business Startups Act of 2012, among others, and have resulted in an abundance of regulations, all needing more and more oversight to stay compliant. These are in the US and other jurisdictions have their own regulations.

The general meaning behind these laws center around creating a market fair for competition and equitable oversight. But in practice, the abundance of regulations has created an entire industry of compliance. The estimate for regulatory compliance and economic effects of federal intervention is $1.9 trillion annually. The financial services industry has some of the highest compliance costs, with the average cost of compliance equalling $30.9 million. Blockchain can severely slash those amounts and at the same time provide better proof of compliance not only for exchanges but across all industries.

Anti-Fraud and Compliance

Customers using Fintech solutions are already paying for regulatory compliance systems. While traditional reports fit nicely on a database there is no proof component involved in the data entry. Dragonchain makes it possible to prove compliance in payments and markets systems in several areas including:

- Market Manipulation such as wash trading.

- Metrics such as volume and reserves.

- Regulatory Compliance such as following policies and procedures.

- Payments Systems such as security for mobile wallets and credit card payments.

- Banking and Financial such as regulatory requirements.

- Controlled Transparency without exposing sensitive data.

- KYC/AML Simplify identity proof and automate compliance with measurable proof.

Our operational POC was able to provide proof that there was no market manipulation occurring which is common practice within, not only cryptocurrency exchanges but legacy exchanges as well. Even though the POC was for a cryptocurrency exchange our Proof Systems can be integrated with any business who needs needs to prove compliance.

Regulations from the SEC and the like will forever be upon us, but there are a few areas that are considered biggies. Areas where exchanges focus to ensure compliance not only for the SEC but for traders as well. Let’s look at a few and see how Dragonchain is addressing the needs exchanges to prove compliance.

KYC/AML

Money laundering is the act of funneling illegal funds through legitimate entities to use said funds legally. Anti-Money Laundering (AML) laws require financial entities to monitor and report suspicious activity. These laws make it harder for criminals to legally use funds obtained illegally. The Financial Action Task Force (FATF) is a world organization of 37 countries and jurisdictions charged with providing standards to prevent money laundering to adhere to AML institutions practice Know Your Customer (KYC).

The purpose of Know Your Customer regulations is to combat unethical behavior such as money laundering and fraud. Regulations surrounding KYC are in place to not only prohibit illegal activities but to protect customers and financial entities.

Know Your Customer requires a financial entity to obtain, at a minimum, a customer’s name, birthdate, address, and identification number. The financial entity must keep required identifying information, and any document used to verify identity and the methods used to verify identity and any outcomes stemming from a discrepancy discovered when verifying identity for five years after the account is closed.

Although a due diligence program is not specifically outlined or mandated through regulations, financial services are required to report suspicious activity. To know what activity is suspicious, the financial entity must collect as much information as possible to adequately “know” their customer. Agencies such as Financial Crimes Enforcement Network (FinCEN), the Federal Deposit Insurance Corporation (FDIC), the Securities and Exchange Commission (SEC), and the International Revenue Service (IRS), to name a few, regulate and enforcing compliance with KYC mandates.

When exchanges go through KYC compliance, MyFii is part of the process. MyFii is an independent entity that securely manages user data. Factor, built at Dragonchain, provides decentralized data management services to companies, organizations, and governments within the current regulatory framework. With MyFii, exchanges handle KYC requirements, without the need to hold personally identifiable information (PII).

In a typical situation, MyFii will procure the required KYC documentation, then arrange for KYC approval via an identity provider. The documentation goes through the approval processes with the identity provider, who then authenticates the customer’s identity. MyFii will then hold only what is minimally necessary to comply with jurisdictional guidelines. MyFii releases the approval factor to the exchange. By using MyFii, KYC is compliant and the exchange is free from having to store PII.

Once the exchange has KYC completed, they will need to comply with anti-money laundering laws. Since orders are on chain, it is immediately possible to use this information to run reports on any suspicious activity. For instance, if $10,000 is traded or withdrawn from the exchange it is flagged and generates a report.

Proof of Orders and Trades

An order book is a list of buy orders and sell orders at each price point. It’s what is referred to as market depth. An order book will also identify who has placed orders of an asset if they choose to be known.

Beyond the fact that the book documents buy and sell orders, each order book provides the necessary transparency into price action, asset availability, depth of the trade, who initiates transactions, and the history of all orders. This transparency is important for traders to make informed decisions when executing a trade as they can see who is buying and selling and whether the price is being moved by institutions or retail.

There are exceptions to this transparency and that is dark pools. Dark pools are hidden orders by large traders. These orders remain hidden to maintain stable valuation of asset prices. For example, if a larger institution wants to sell a large amount of an asset and the public is aware of the order before execution it can lead to a significant devaluation of the asset. If the transaction is reported after the fact the impact on the entire market is markedly lower.

By placing individual orders on chain when created, the end user can see proof of timing of every order associated with their executed purchase or sale. Proof Systems provide evidence for both the trader and the exchange that all transactions occurred well in advance of their fulfilled order, providing a measurably provable trusted environment.

Proof of Trades is not to be confused with the Proof of Orders. Dragonchain provides Proof of Trades by placing all completed trades on chain. Full proof reports of the trade can be supplied to the traders or the regulators to prove trade is legitimate.

Dragonchain provides Proof of Orders for exchanges who run their order books through the platform. Every order entered into the system will be on chain and easily provable.

Proof Report

The POC included proof reports of all completed trades for many trading pairs on the exchange. A Proof Report is the history and breakdown of a Dragonchain transaction. Not unlike a block explorer, the report provides information essential to proving chain of custody by showing the transaction ID, timestamp, raw data, and the hash of Ethereum or Bitcoin. These reports can further be used to prove compliance to regulatory authorities should the need arise. See for yourself!

Proof of Volume

Volume is the measure of the total amount of shares exchanged between buyers and sellers for a given period of time. The volume of the trade will indicate the activity and liquidity of a trade. Liquidity refers to the ability to buy or sell an asset quickly while maintaining its value. High volume and liquidity yield ease of buying and selling. Low liquidity results in a more difficult time buying and selling the asset and often resulting in a significant increase or decrease in valuation.

Exchanges track the volume of trades and provide the data to the traders. Volume is reported hourly and is estimated. The volume reported at the end of the day is also an estimation. The final volume numbers will be reported the following day.

Volume is important for traders as it indicates the significance of any increase or decrease in asset price. For example, if the price action of an asset moves a large amount and the volume is matched, then it is seen as strength. But, if the price moves with no volume behind the move, then the asset may not be supported by most of the market and the value may reverse.

Accurate volume reporting is important as it provides traders with an accurate picture of the current state of the market and gives them the ability to make informed decisions. By placing every order and every trade on chain Dragonchain can easily compile the data to prove volume data.

Front-Running

Front-running is when a broker or entity has prior knowledge of a non-public order that is set to take place and acts on the prior knowledge. In addition, exchanges themselves are at risk of front running by acting on prior knowledge or giving an unfair advantage to a big investor. This creates an unfair advantage. For example, a client informs a broker of their intent to purchase 250,000 shares of an asset. Then the broker places an order of its own before the client so that the broker gets a better price. The rise in price from the client’s purchase creates a profit for the broker. It is important to note that if the broker has knowledge of a public order and makes a purchase it is not considered front-running because the information is public and everyone has the same advantage.

To prove no front running is taking place on the exchange, Dragonchain is providing Proof of Timing. The timing of when orders are placed and executed is visible in the proof report as each transaction is timestamped.

Wash Trading

Wash trading is when a trader buys and sells a cryptocurrency, or a security in traditional exchange, with the intent of misleading market information. Not only is it illegal, the IRS says you can’t deduct losses from wash trading. The purpose of wash trading is to deliberately influence interest from the perceived activity of an asset. The sparked interest will temporarily increase the asset’s price, however, when the lack of real interest is shown to sustain the increased price the asset decreases in valuation. The trader will profit by shorting the asset back to prior levels.

Wash trading continues to be a problem in all markets, including in cryptocurrency. A recent article in Decrypt reports on the call by researchers for popular price tracking websites to highlight wash trading. Informing users of the practice does nothing to combat the problem. Exchanges must actively work to put a stop to wash trading. Then provide proof that it isn’t happening to the price tracking services.

Exchanges can prove to regulators that wash trading is not happening with MyFii. Without exposing personal data, the exchange can flag events that are statistically not normal. For example, the system can watch for when two traders take opposite trades on the same asset. An event like this can lead to further investigation and/or appropriate consequences for the two traders. The proof can further be disseminated to asset price tracking services, regulators, and customers.

Integrate Proof Into Existing Regulatory Compliance Technology Solutions

From surveillance and financial risk in capital markets to software solutions for intelligent decision making for compliance, trade surveillance, and risk management, there are many regulatory technology and software companies available for your business to maintain regulatory compliance. Some of the most common services offered include:

- Alerts intelligence and workflows

- Reporting and analytics platform

- Surveillance capabilities

- Regulatory reporting

- Resilience services

- Regulatory remediation

- Enterprise compliance risk management

Dragonchain can offer proof of these common services with simple integration into your existing software, RegTech, and workflows already operational in your business today.

Can’t Afford Non-Compliance

Instituting and supporting Proof System measures do not require public knowledge of personal data or business logic. Dragonchain’s Proof Systems are a hybrid of private and public architecture by design and sensitive information is never exposed publicly unless explicitly permissioned. In some use cases, a company might want to or need to expose pieces of information on public networks. While in other cases, information can remain private or only shared within a consortium to authorized parties. Even without exposing information publicly, at a later point in time, there is proof that a certain event happened at a specific day and time.

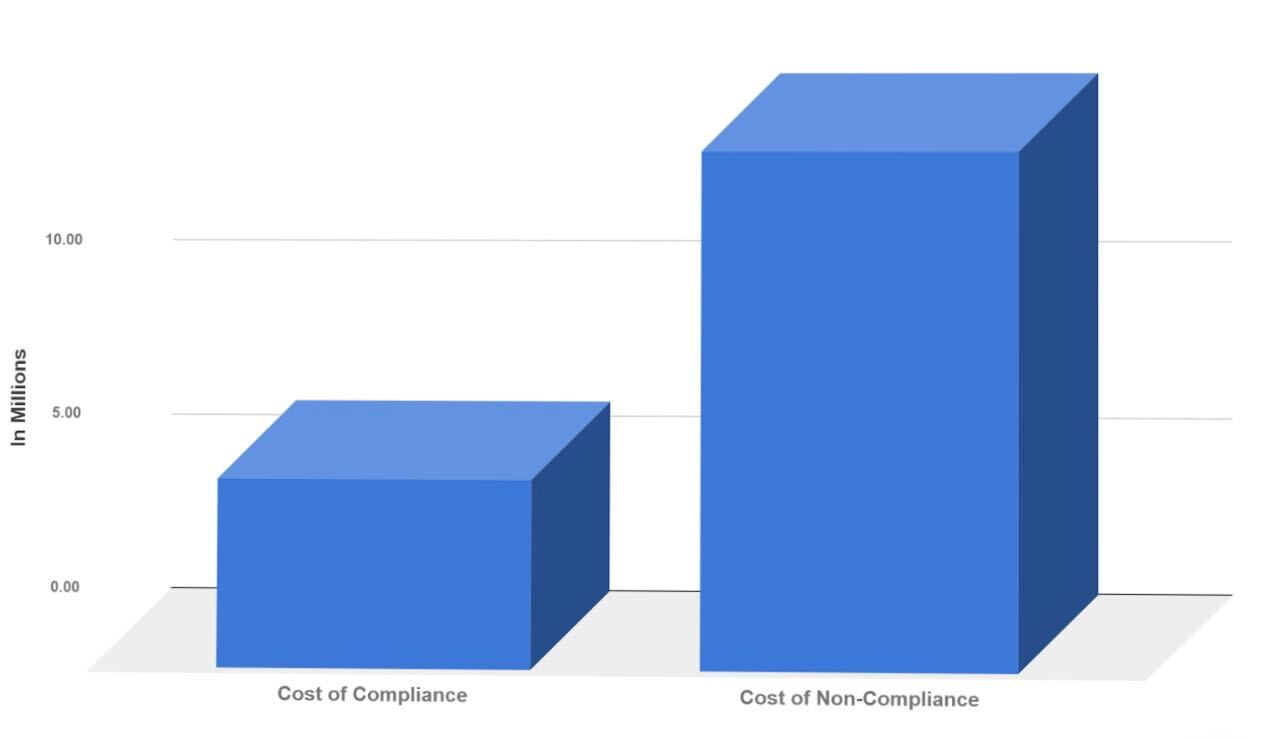

On average, the cost of non-compliance is $14.82 million for a business and is more than twice the cost of maintaining compliance at \$5.47 million. Implementing a Proof Systems program will not only provide businesses measurable proof for regulators, it will also save from lost revenue.

Compliance has a new dimension, and its proof. From water quality to voter registrations, from micro-transactions to market orders and everything in between Proof Systems will prove anything that needs proving.

Today we’re solving the problems that have plagued the Fintech industry for years. By giving exchanges a way to prove they are following regulations to support a fair exchange we are empowering the trader and producing a healthy market structure for all.

Learn more about Dragonchain’s Proof Systems or contact us directly.